Bitcoin had a great 2016. The cryptocurrency rallied 120% to $952, threatening to break the $1,000 mark for the first time since 2013. While bitcoin has seen a consistent bid throughout the year, its 57% gain (in US dollar terms) over the past three months has been particularly impressive.

So what’s behind the move?

China.

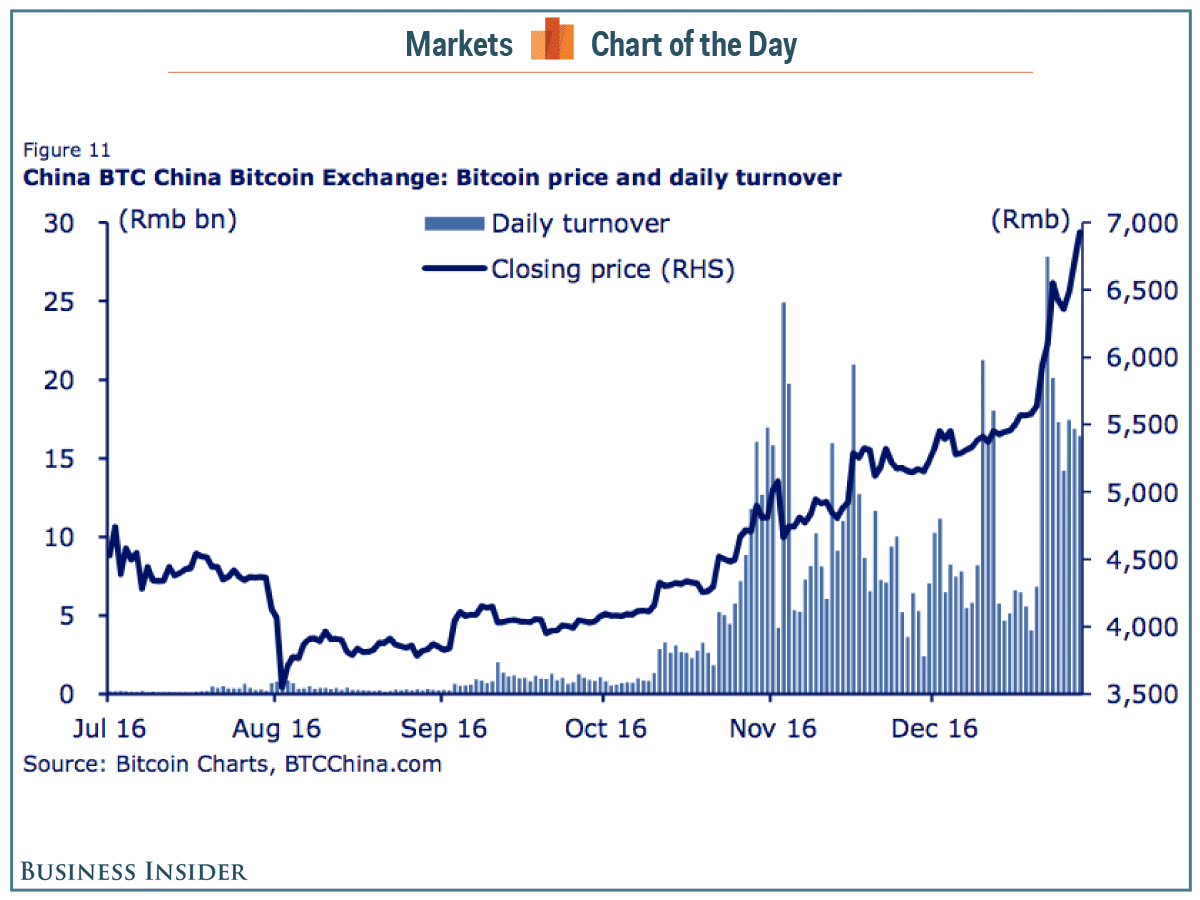

In his latest edition of “Greed & Fear,” CLSA’s Christopher Wood notes, “Daily turnover in Shanghai-based BTC China, the world’s largest bitcoin exchange by volume, has risen from around Rmb1bn in late September to a peak of Rmb27.8bn on 22 December and Rmb16.4bn on Wednesday (see Figure 11) while the Bitcoin price has risen by 70% over the past three months to Rmb6,927.”

The increased volume in the cryptocurrency comes as money continues to rush out of China. The country saw its foreign-exchange reserves shrink by about 8% in 2016 to $3.05 trillion as of November. The drop in reserves has occurred as China's currency, the yuan, weakened by 6% against the dollar in 2016. The currency is threatening to weaken below 7.00 per dollar for the first time since Q1 2008.

Things aren't expected to get better anytime soon, either.

Deutsche Bank strategist Gautam Kalani recently called the yuan "the most expensive" currency in the world on a trade-weighted basis. While he didn't go into specifics, his call most likely has to do with the fact that as the dollar strengthens on expectations for Federal Reserve interest-rate hikes, the yuan gets weaker and money pours out of China.

Additionally, Bloomberg economist Tom Orlik wrote, "China's corporates continue to hold on to almost half of their forex earnings - a sign that yuan depreciation expectations remain high."

In fact, it's possible that the yuan's depreciation kicks into a higher gear, causing money to flee China at an ever faster rate. That's because at its most recent policy meeting, the US Federal Reserve appeared to be a bit more hawkish than previously expected. The Fed said it had begun to expect three rate hikes in 2017, up from its previous forecast of two. If that happens, the dollar will get even stronger, and the yuan will get weaker.

Of course, that will be even more positive for bitcoin.